Table of Content

These 6 coverages are nearly guaranteed to be included in your basic homeowner’s insurance plan. The roof provides protection for the home and its contents against the elements. Any damage or potential risk that can lead to water seepage, entail a greater chance that anything under it can be damaged as well. Water can damage wood panels, ceilings, electrical circuits, and every appliance or furniture within your home. As such, you can expect that a home insurance inspector will meticulously go through every inch of your roof to look out for any damages or signs of an impending leakage.

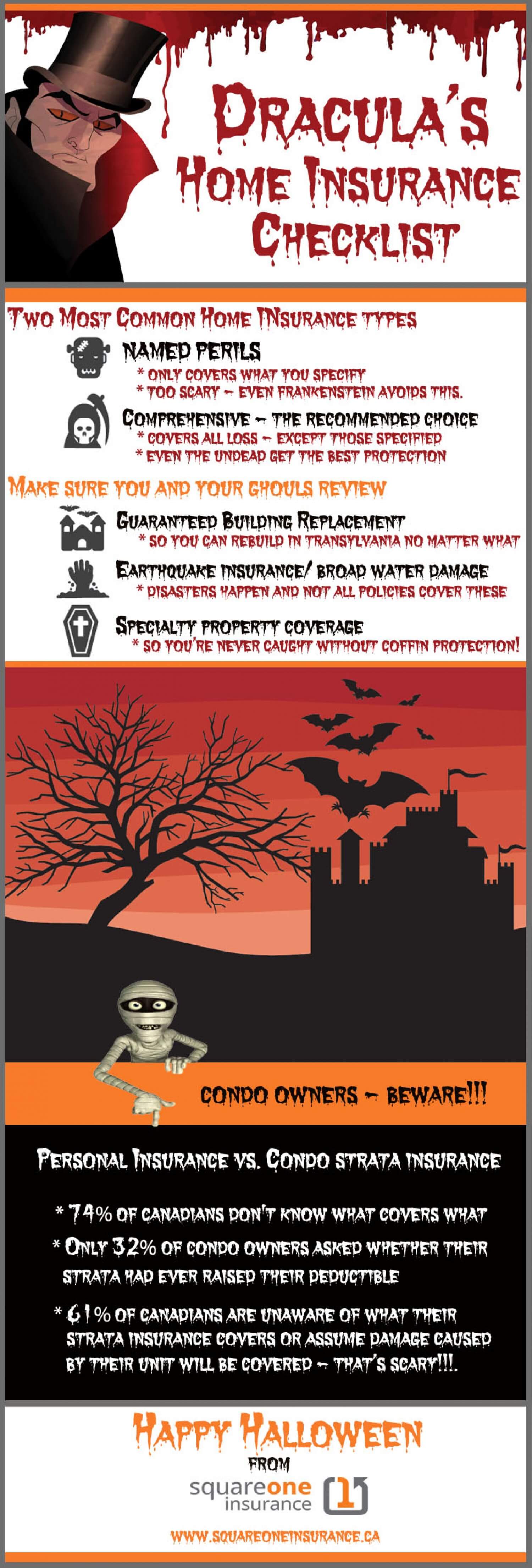

Standard policies generally include the following types of coverage. Some of the biggest payouts in court occur when someone files a claim or lawsuit against an injury or incident that happened on someone’s property. If that property is yours, and you are found liable for and someone getting injured on your property, you will be the one paying for it.

What to bring for a faster homeowners insurance quote

For first-time buyers, the task of ensuring that they’re buying their money’s worth can be overwhelming. With so many things to consider, the tendency of going for the smooth and easy way to acquire the property can truly be tempting. But for an experienced or well-informed buyer, they know better.

In case your house gets burned down due to an accidental fire or is destroyed in an insured disaster, you should be able to rebuild the house from top to bottom. With this coverage, you can replace valuable items and have protection from liability if someone sues you or gets injured on your premises. Are you unsure if your business activities are covered by an insurance policy?

Plumbing and electrical systems

The market value is the amount the home would sell for on the, well, market. These two amounts are not the same, and your insurance should cover your home for its replacement cost. (That’s the coverage you’d need if a fire burned your home to the ground, after all.) So, that’s why it makes the home insurance checklist. No matter how dreamy a property appears to the buyer during a walk-through—or how much the seller has enjoyed living there—serious issues may lie beneath the surface. Before closing the sale, it's a good idea to determine the home’s current condition by having a professional home inspector take a look.

A home inspector will see to it that your appliances are in good working condition. Any unit that does not conform to the standards of its proper usage poses a risk of damage to your property and even to your family. The structural integrity of your home safeguards you and your insurer against the threat of any major disaster.

The Quillionaire Checklist

A home inspection shouldn’t be confused with a home insurance inspection, however. A home insurance inspection is something your homeowners insurance company may require as a condition of getting covered. Your home is one of your biggest investments, so we understand why you would want to protect it dearly.

Of your property, you need to ensure it is properly maintained. If you want to make any additions or alternations to the policy, inform your agent immediately. This way, you won’t have to worry about being under-insured or over-insured. It pays for rent when your house is destroyed by a covered peril, and you are forced to live in an apartment until your house gets rebuilt. It pays for any medical care and legal costs if someone is hurt on your premises.

Homes near the coast will be more expensive to insure because the risk of hurricane, wind or water damage is greater. In many states, you will pay the first few thousand dollars in damage before your insurance kicks in. You also need to think about the threat of floods or earthquakes. You will need separate insurance for these risks and it can be costly. Also, around the country, there are high-risk areas vulnerable to hurricanes, brush fires or crime that might not qualify for private insurance.

To dispute information in your personal credit report, simply follow the instructions provided with it. Your personal credit report includes appropriate contact information including a website address, toll-free telephone number and mailing address. Download our helpful Homeowner’s insurance checklistfor your own use! If you ever have questions regarding what is or isn’t covered by your homeowner’s insurance, don’t hesitate to call us.

Reconstruction cost is what it would cost to replace your house by rebuilding it completely at current prices. Market value is what someone is willing to pay for your home including the lot. The limit of insurance carried on your home should be based on its reconstruction cost. Before applying for homeowners insurance, check your credit report and credit score, and take steps to improve your score if necessary. You can look for homeowners insurance online at insurance company websites or use an insurance comparison site to evaluate different providers. A home is most people's biggest investment, so shouldn't you protect yours with homeowners insurance?

A home inspection is an examination of a home's physical structure and systems, from top to bottom, to determine their current condition. The inspector identifies issues ranging from minor cosmetic defects to significant material defects that affect the home’s value—or even make it unsafe to live in. Essentially, a home inspection gives you, the buyer, a heads-up about what may need immediate or eventual repairs.

Talk to your insurance advisor about adequately insuring motorized vehicles — such as a riding mower, go-cart, golf cart, personal watercraft, or even grandma’s mobility scooter. It’s also not a bad idea to look at the home insurance discounts you qualify for. Have you made any changes to your house or in your lifestyle that could help you get lower rates through a discount? (Some common discounts include having a home security system.) Part of your home insurance checklist can be making sure you’ve got all the discounts you qualify for. Even if you don't live in a flood-prone area, flood insurance can save you thousands of dollars on damage caused by storms or other unpredictable disasters.

Guaranteed replacement coverage covers the cost of rebuilding no matter how much it exceeds your dwelling coverage limits. If you have an older home, consider ordinance or law coverage, which pays to rebuild your home to current building codes. Older homes sometimes have features such as plaster walls, ceiling molding and wooden floors that could be costly to replace. Also, an older home that has been updated to comply with current building codes is typically less expensive to insure than an older home that is not up-to-date.

No comments:

Post a Comment